“Regarding some of the taxes that should be paid on personal flights, we doubt that some of these taxes are being paid,” Bowen told Religion News Service in a phone call from the foundation’s office in Dallas. “A 990 will disclose if they use private or charter aircraft. But most televangelists don’t provide that information to their donors, so we’re doing it for them.”

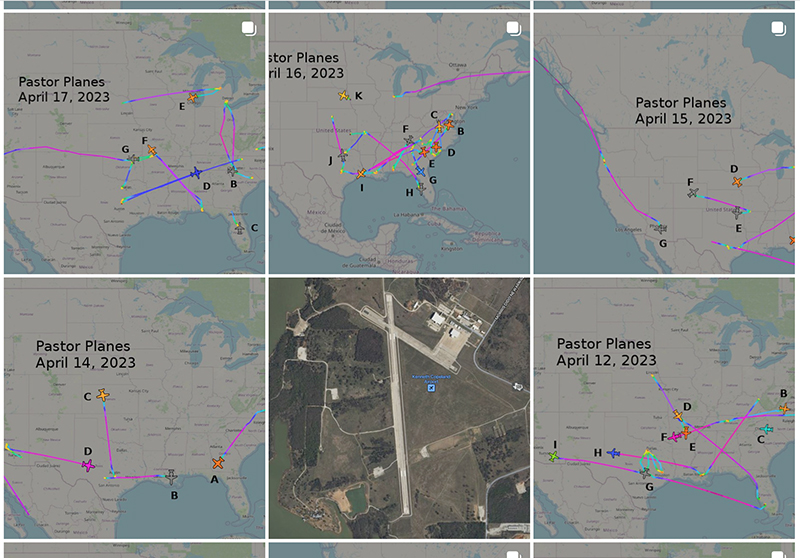

Instagram posts of ministry-owned jet routes from Trinity Foundation’s @pastorplanes account. Screen grab

Evans added that by tracking pastor flights, Trinity Foundation hopes the public will ask Congress to better monitor how religious groups use their finances.

“Most of the televangelists we investigate claim to be a church, even though the church is a minor part of the organization. The largest part of it is online donors and their ministries. We’re trying to encourage more transparency and more accountability.”

Bowen and Evans call themselves “sold out” believers, and both attend small local churches. But they each recall becoming disillusioned by prosperity gospel preachers who they believe manipulate the gospel to accumulate wealth.

“My grandmother would donate to Robert Schuller,” Evans recalled, “so probably a huge part of my mother’s inheritance was frittered away to build a Crystal Cathedral in California.” Bowen still recalls flipping through TV channels in the early 2000s and watching Murdock tell viewers that if they sowed a seed on their credit card, God would erase their credit card debt.

“At that point, I made a commitment to start investigating them, to do what I could to oppose the prosperity gospel. It was a defining moment,” Bowen said.

While jet-owning televangelists are both highly influential and highly visible, these tax changes will only impact a small subset of pastors, Brunson said, noting that few pastors work for congregations wealthy enough to own private jets. He added that the IRS issues such changes and updates on a regular basis.

“It’s relevant to pastors, but it’s not really a surprise,” he said.

But for those like Bowen and Evans who want to hold pastors accountable for their finances, staying up-to-date on these tax changes is a must.

“We believe in donor responsibility, and a lot of donors have no idea how much money has been wasted on travel expenses by some of these people,” said Bowen.

This story has been updated to show that Mike Murdock’s ministry no longer owns a jet.

This article originally appeared here.