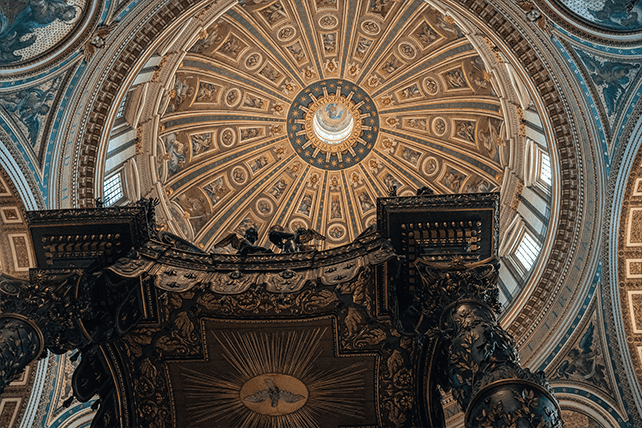

The London property at the heart of the Vatican financial scandal. Image via Google Maps

Prosecutors investigating the London property deal have accused three fund managers — Raffaele Mincione, Gianluigi Torzi and Enrico Crasso — of defrauding the church out of millions of euros. Under the new plan, the investment committee will select and oversee outside portfolio managers, “verifying that they have proven experience, sufficient technical competence and appropriate ethical standards, as well as being free of conflicts of interest.”

APSA and the Secretariat for the Economy will nominate the president and four members of the investment committee, for the pope’s approval. A compliance officer, appointed by the prefect of the secretary for the economy, will guarantee “the transparency and proper functioning of the committee, respect for existing norms” as well as compliance with the investment policy. That person will also ensure there are no conflicts of interest and monitor risk, the statute read.

While the committee will act under the vigilance of APSA and the Secretariat, the statute does not say whether it will fall under the jurisdiction of the Vatican’s anti-money laundering entity, the Financial Supervisory and Information Authority, or ASIF.

The guidelines go into effect in September.

This article originally appeared here.