(RNS) — Chris McMahon found success with his Pittsburgh investment firm, MFA Wealth. But he said he regrets not being upfront about his Catholic faith earlier in his career, and is trying to make amends the best way he knows: by helping Catholics put their money where their faith is.

Through his recent venture, Aquinas Wealth Advisors, McMahon, 60, offers Catholic parishes, dioceses, institutions and individuals the Faith & Finance Score, a tool powered by artificial intelligence that issues report cards showing investors whether their money is funding causes that could be seen as contrary to Catholic values.

A longtime figure in conservative Catholic business circles, he said his screening tool targets “anti-Catholic” causes — abortion, pornography and LGBTQ+ activism.

“Most Catholics have no idea what they own,” McMahon, who is also the author of “Faithful Finances,” told Religion News Service. “And in many cases, their money is being used to undermine their own faith.”

RELATED: John Legend Debates Abortion With Christian YouTuber Ruslan

Faith-based investing, while not new, is gaining popularity. According to Business Insider, faith-driven investments have grown over $100 billion, seeing a 14% increase since June 2024. In the Catholic investment world, established players such as the Knights of Columbus Asset Advisors and Ave Maria Mutual Funds have long offered values-based fund options. McMahon’s tool, however, aims to do something different by catering to individual Catholics and promoting transparency, while waging a financial battle against what he calls “wokeism.”

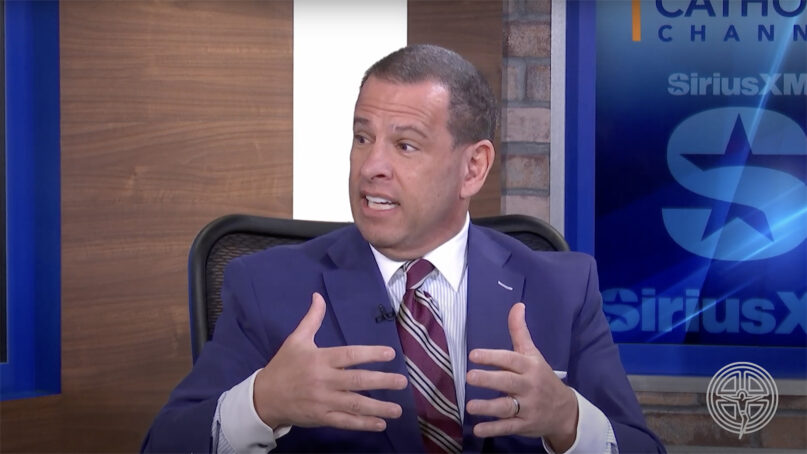

Catholic financial adviser Chris McMahon discusses faith-aligned investing with Cardinal Timothy Dolan. (Video screen grab)

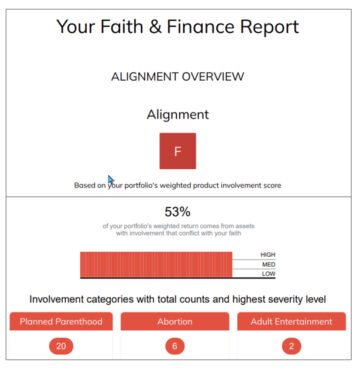

His company’s Faith & Finance Score grades investments from A to F based on Catholic faith alignment and performance. It shows investors whether their funds could be used to promote abortion, pornography, human trafficking and LGBTQ+ advocacy. It gives positive marks for companies that treat workers well, have preferential treatment for the poor and demonstrate care for the environment.

“Certainly, we test for the positive markers. But we’re first trying to eradicate, or shed a light on, the obvious anti-Catholic things that are going on,” McMahon said.

The Vatican issued a 45-page document in 2022, “Mensuram Bonam,” or “A Good Measure,” that laid out guidelines for faith-based investments. In line with Catholic teaching and Pope Francis’ priorities, it encouraged Catholics to invest in companies that care for the environment, the poor and workers. But according to McMahon, the document “doesn’t give people tangible action steps to take.”

Aquinas Wealth Advisors was formally established in 2021, and McMahon continues to serve as president and CEO of MFA Wealth.

McMahon is no stranger to influential Catholic financial circles. He was the vice chair of Legatus, a Catholic business association founded by Tom Monaghan, the billionaire philanthropist who founded Domino’s Pizza and Ave Maria University in Florida. McMahon also sits on the board of Duquesne University in Pittsburgh and is a regular attendee of gatherings at the Napa Institute, an organization aimed at promoting Catholic leaders that was founded by Tim Busch, the lawyer, businessman and philanthropist.

An example of a Faith & Finance Score Report on the Aquinas Wealth Advisors website. (Screen grab)

McMahon said he serves many Catholic parishes and dioceses, offering his tools to “look behind the curtain and see what they’re really funding.” While he would not identify his clients due to privacy concerns, he said his company helped a Catholic foundation discover that 40% of its $40 million in investments was in companies that donated to Planned Parenthood.

“We go to bishops all the time — we tell them, ‘Bishop, last year your diocese paid for 310 abortions,’” he said.

McMahon also said 80% of Catholic institutions he works with had investments with RCI Hospitality Holdings, a Houston-headquartered company that operates strip clubs and adult entertainment media, through mutual funds and exchange-traded funds. For example, he said one diocese learned that four of its funds included businesses involved in pornography.

McMahon’s score also flags investments in companies that support the American Library Association and Human Rights Campaign, which support LGBTQ+ rights and trans activists.

His experience leading a traditional investment company led McMahon to identify gender ideology and progressive diversity, equity and inclusion policies as the enemy, he said. He criticized HRC’s Corporate Equality Index scores, which rate companies based on practices toward LGBTQ+ employees, and NASDAQ diversity mandates as perpetuating a financial landscape adverse to Catholic values. He said investment companies such as BlackRock, State Street and Vanguard put pressure on companies to promote progressive agendas.

“The public square has been hijacked by ESGs,” he said, referring to environmental, social and governance investment principles. “If Catholics don’t step forward, we’re going to keep funding the very things we’re fighting against.”