The DOJ’s lawsuit states that Johnson arranged “false and inflated” appraisals through Andrew Bryant and Christopher Bryant, who along with Johnson were named as defendants in the initial complaint.

“Because of these abusive bargain sale transactions, the IRS has expended significant resources,” stated the DOJ, which is seeking a permanent injunction against the defendants.

A permanent injunction is a court order that requires a party to do or not do specific actions on an ongoing basis. Basically, the DOJ seeks to prevent the defendants from carrying out any “abusive bargain sale transactions” in the future.

In the time since the DOJ filed its complaint, Christopher Bryant has agreed to a permanent injunction, although without admitting to the allegations. He has therefore been removed from the lawsuit, leaving Johnson and Andrew Bryant as the active defendants.

RELATED: Gunman Hijacks Samaritan’s Purse Plane: ‘We Praise God That No One Was Seriously Injured’

In a filing on Oct. 14, Johnson denied the DOJ’s allegations of abusive behavior and demanded a trial by jury.

DOJ Lawsuit Against Johnson Mirrors 5 Other Suits Against Welfont

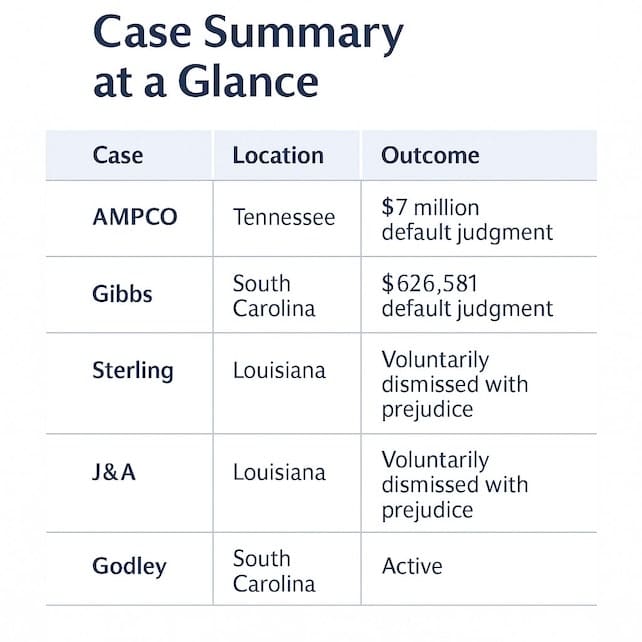

Before the DOJ lawsuit was filed, property owners in South Carolina, Tennessee, and Louisiana sued The Welfont Group, alleging conduct that is nearly identical to what the DOJ is accusing Johnson of.

American Properties Co. v. Welfont Group LLC et al. (Default Judgment of $7 Million)

In May 2022, American Properties Co. (AMPCO) sued The Welfont Group, Bryant’s Asset Advisors (BAA), Andrew Bryant, Tax Appraisal Group (TAG), and Lynda Scull. Lynda Scull appears as a contact for Welfont on three business documents in 2015.

AMPCO said that it owned a property (a neighborhood shopping center) in Memphis, Tennessee, that it listed for sale in July 2018 for $3,995,000. Welfont approached AMPCO and suggested that AMPCO “obtain a Qualified Appraisal of the Property in order for AMPCO to sell the Property to a qualified charitable organization that Welfont represented,” according to the suit. AMPCO claimed that Welfont found a qualified charity called Food Assistance, Inc.

According to AMPCO, Welfont was, without AMPCO’s knowledge, simultaneously negotiating a subsequent sale between Food Assistance and a buyer called Hickory Hill Properties, LLC, “at a price substantially less than fair market value but substantially more than the cash received by AMPCO.”

Welfont connected AMPCO to TAG/Scull, who introduced AMPCO to BAA and Bryant, according to the suit, and BAA and Byrant provided the appraisal. The property was appraised for $4,755,000. AMPCO said that it did not know at the time that the qualified appraisal was in fact not compliant with the requirements from the IRS and other governing bodies.