(RNS) — The Rev. John Parks was taking his first sabbatical in 40 years of ministry when he got a call from his church’s accountant with some bad news.

Church Mutual, the church’s insurance company, had dropped them.

“This does not make sense,” Parks, the pastor of Ashford Community Church in Houston, recalls thinking at the time. “We’ve never filed a claim.”

Five months and 13 insurance companies later, the church finally found replacement coverage for $80,000 per year, up from the $23,000 they had been paying.

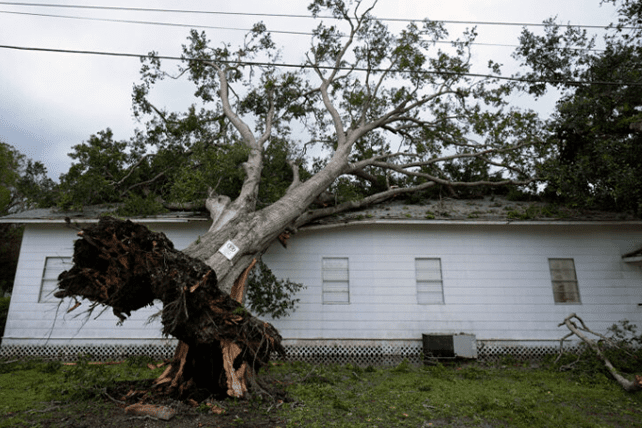

“It’s been an adventure,” said the 69-year-old Parks from his home in Houston, where the power was out after Hurricane Beryl. “That’s putting it politely.”

Parks and his congregation are not alone. An ongoing wave of disasters — Gulf Coast hurricanes, wildfires in California, severe thunderstorms and flooding in the Midwest — along with skyrocketing construction costs post-COVID have left the insurance industry reeling.

As a result, companies such as Church Mutual, GuideOne and Brotherhood Mutual, which specialize in insuring churches, have seen their reserves shrink. That’s led them to drop churches they consider high risk in order to cut their losses.

Hundreds of United Methodist churches in the Rio Texas Annual Conference learned they’d lost property insurance in November last year, leaving church officials scrambling. More than six months later, some churches have found new insurance, often at a steep increase. Others still have none, said Kevin Reed, president of the conference board of trustees.

Reed said the conference had about a month’s notice that its property insurance policy, which local congregations could buy into, was being canceled. That wasn’t enough time to find new coverage before the policy expired. It also left local churches on their own.

We have not found a good solution,” said Reed. “It continues to be a significant problem for our churches.”

United Methodist churches in Iowa have also lost insurance, according to the Iowa Annual Conference, in the aftermath of severe weather in the area. The Rev. Ron Carlson, treasurer of the Iowa conference, said that both small rural churches and larger churches have been affected. Carlson said the conference reminded churches earlier this year to be proactive in checking on their insurance and not waiting for a renewal offer.

The UMC’s Book of Discipline requires churches to carry insurance for the full replacement cost of their buildings as well as liability insurance. For some churches, said Carlson, that’s just not possible. He said the conference is trying to sort out what happens to those churches.

For struggling churches dealing with declining membership and giving, he said, rising insurance may be the last straw.

“There have been some that have said we can’t do this anymore,” he said.

For churches that lost their insurance, finding replacement coverage is difficult. That’s in part because churches are a niche market that’s difficult to insure and full of risk, say experts. They are open to the public, work with everyone from infants to senior citizens, sometimes house social service programs, are run by volunteers and often have large and expensive buildings.

Churches also operate with little oversight, said Charles Cutler, president of ChurchWest Insurance Services, which works with about 4,000 churches and other Christian ministries.

“Because of the First Amendment and the separation of church and state, ministries are largely unregulated,” said Cutler. “And unregulated businesses are difficult to underwrite.”

The church insurance market, like the insurance industry overall, has been hit with a perfect storm in recent years. Supply chain shortages for construction materials that began during the pandemic have driven up the cost of rebuilding after a disaster. When the cost of rebuilding goes up, so does the size of claims, said Cutler. That led insurance companies to raise their rates in order to cover those claims.